Who Is This For?

TurboTax Live customers who fall into different assistance mindsets based on their control and understanding needs: Auto Pilot (low control, low understanding), Student (high understanding, low control), Pilot (high control, low understanding), and Co-Pilot (high control, high understanding). The primary audience includes both new and returning users who get stuck on complex tax sections and need expert guidance without losing autonomy.

What & Why

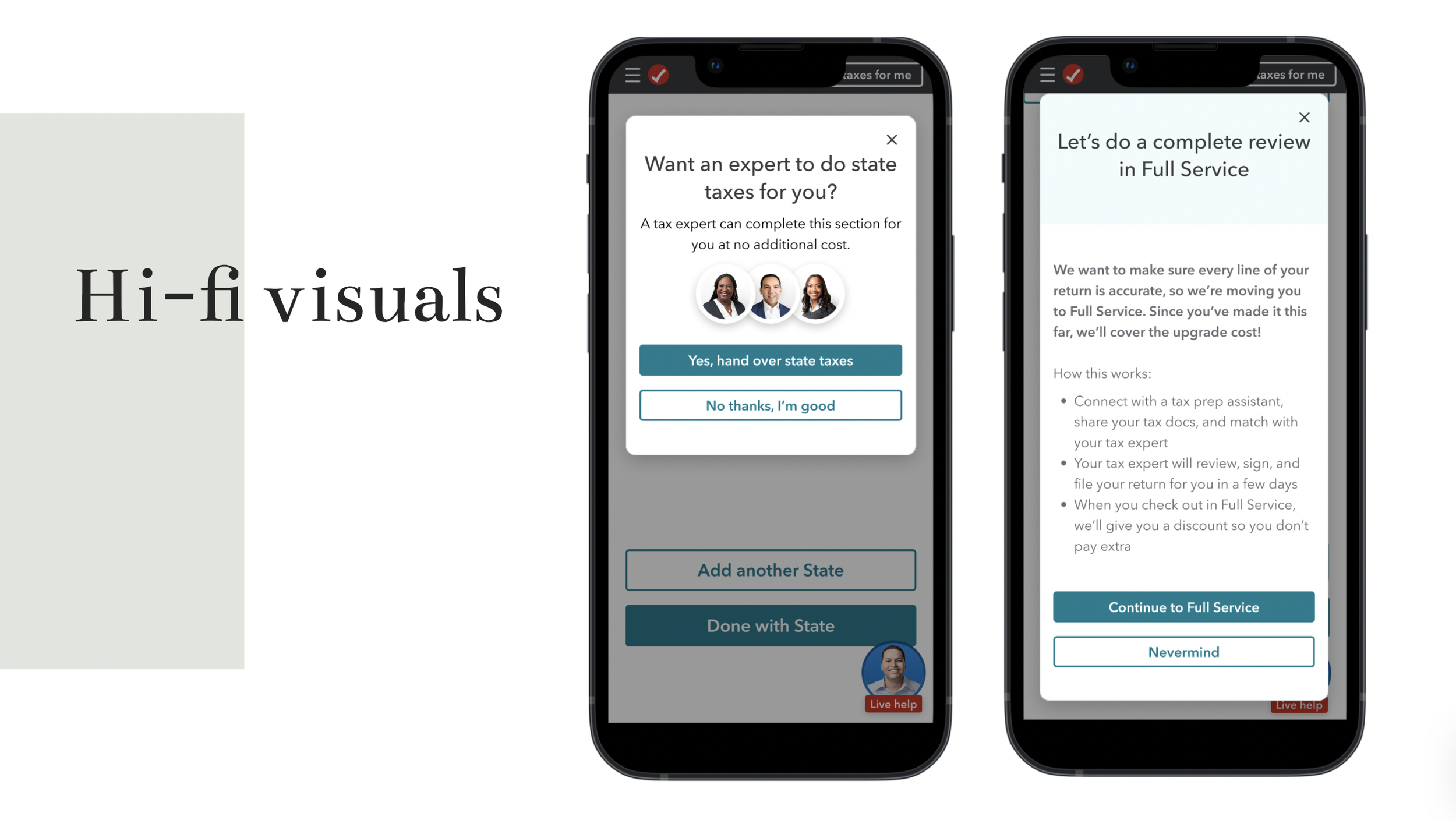

The Goal: Enable customers to hand off specific complex sections of their tax return to experts while maintaining control over the overall filing process—introducing "micro-delegation" as a middle ground between DIY and Full Service.

The Problem: Users were experiencing friction when they got stuck on challenging sections, expressing that "getting help is too much work," they "don't want to lose momentum," and "the burden is on me to act on the advice I receive". The challenge was creating a seamless way to get targeted expert help without upgrading to full service.

Why It Matters

Ideal State: Users can confidently navigate their tax return knowing they can instantly hand off challenging sections to qualified experts, then review and approve the completed work—maintaining control while accessing professional expertise when needed.

Impact: Increased customer confidence in filing, reduced abandonment at complex sections, improved conversion rates, and enhanced engagement with TurboTax Live services.

Context & Process

Discovery Phase: Comprehensive stakeholder mapping, experience audit, customer empathy research, and understanding system limitations across two core teams.

Challenge Areas: Navigating product limitations and legal constraints that impacted implementation. Key challenges included delegation thresholds, legal constraints under Section 230, and limited DIWM capabilities within the existing product infrastructure. The team had to work within these constraints while designing solutions that met both user needs and regulatory requirements.

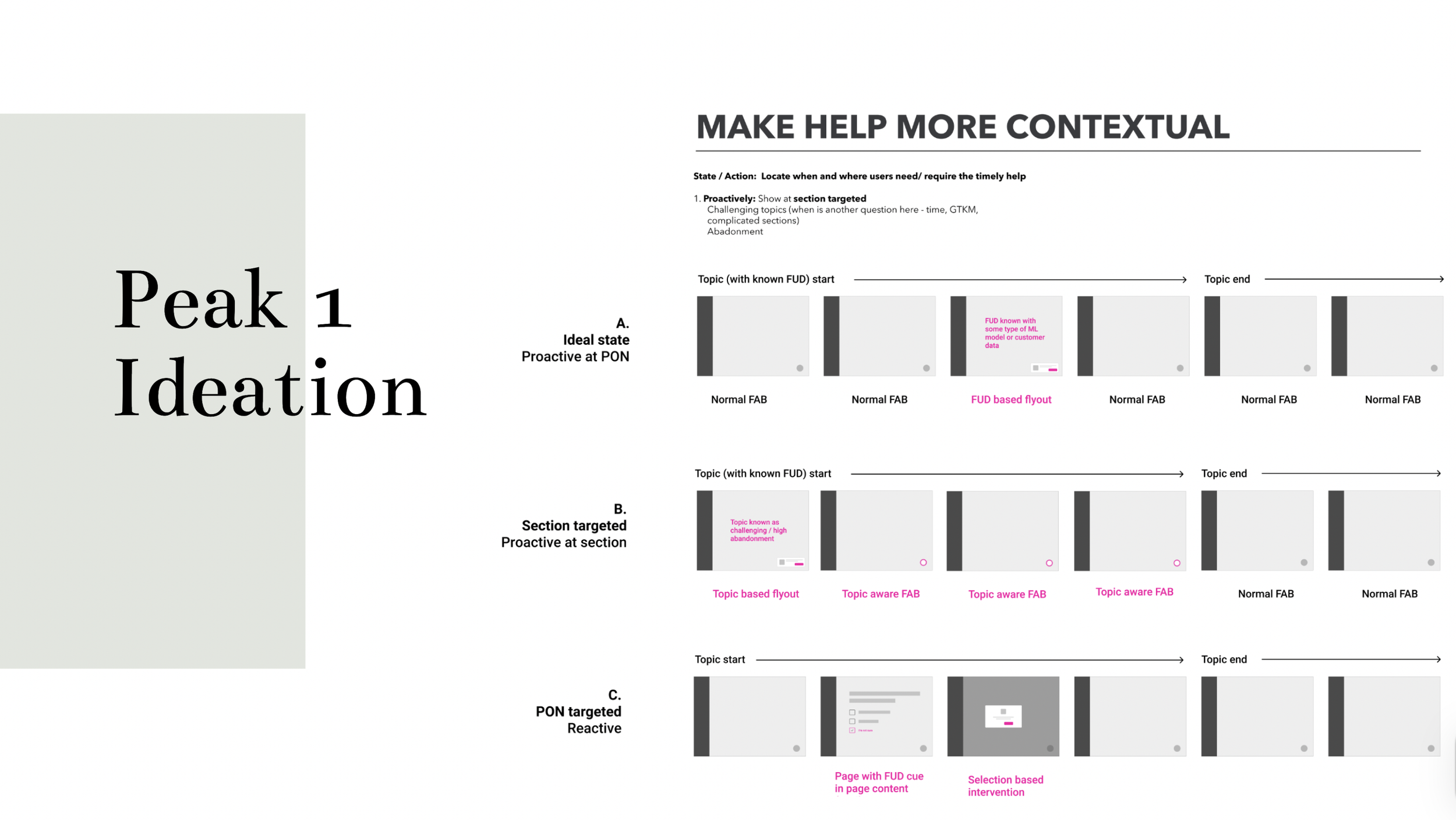

Design Process: Two-peak ideation approach focusing on lowering barriers to connect with experts and making help more contextual through proactive and reactive interventions.

What We Changed

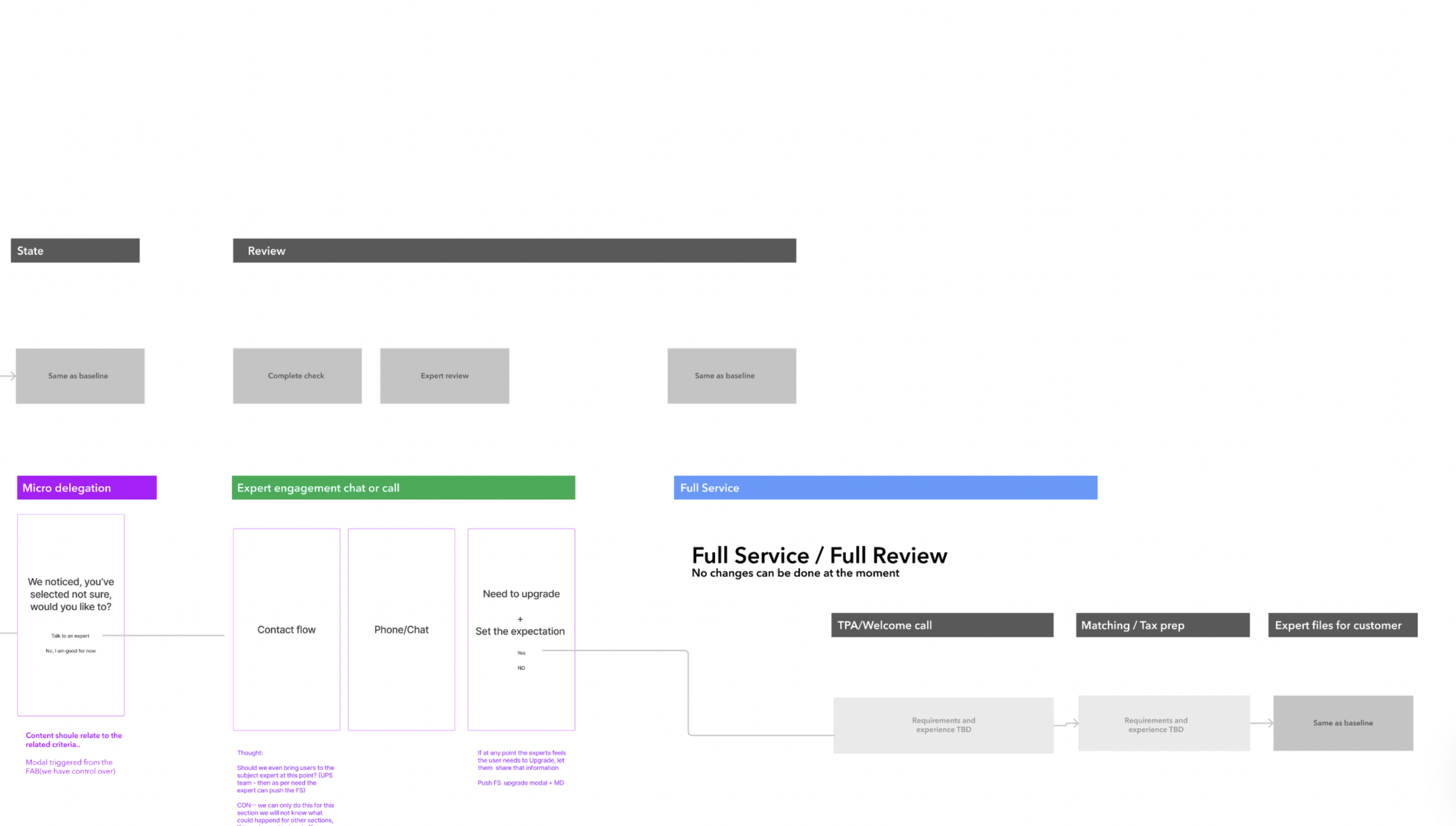

Peak 1 Solutions:

Proactive help placement at challenging sections with known high abandonment rates

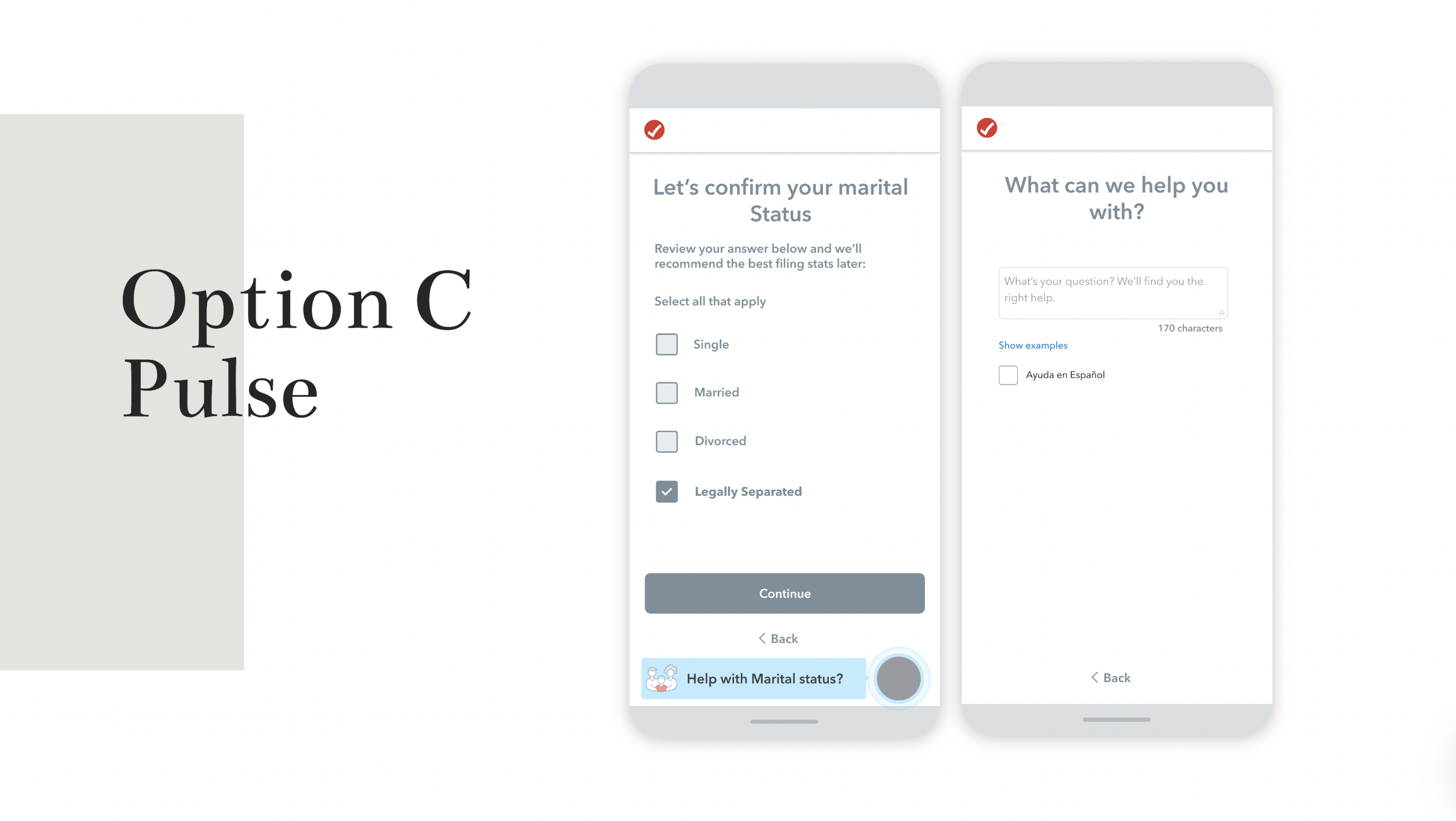

Contextual assistance triggered by user uncertainty signals ("I'm not sure," "none of these apply")

Three intervention approaches: modal overlays, flyouts, and pulse notifications

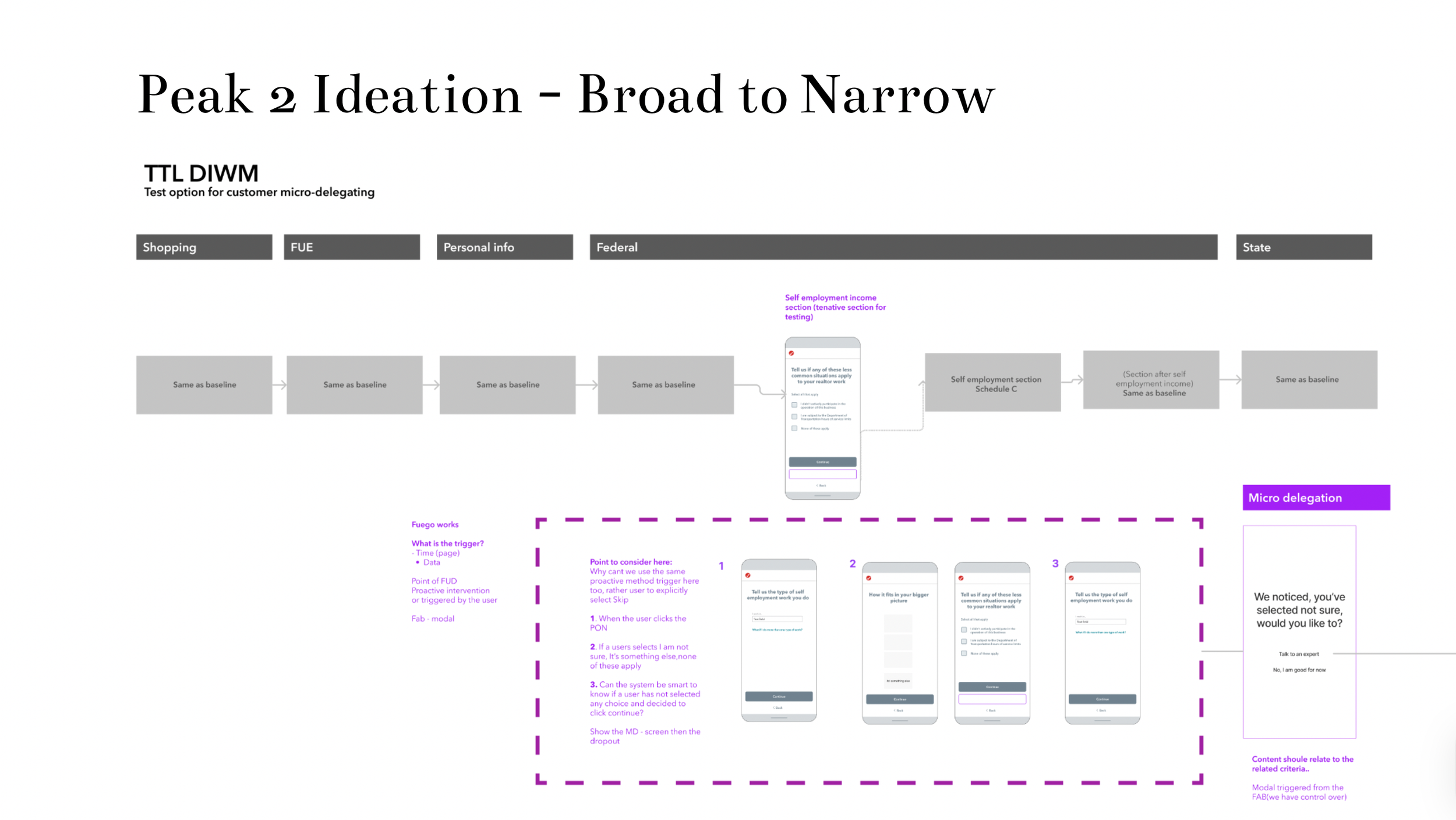

Peak 2 Solutions:

Micro-delegation flow allowing users to hand off specific sections (tested with self-employment income)

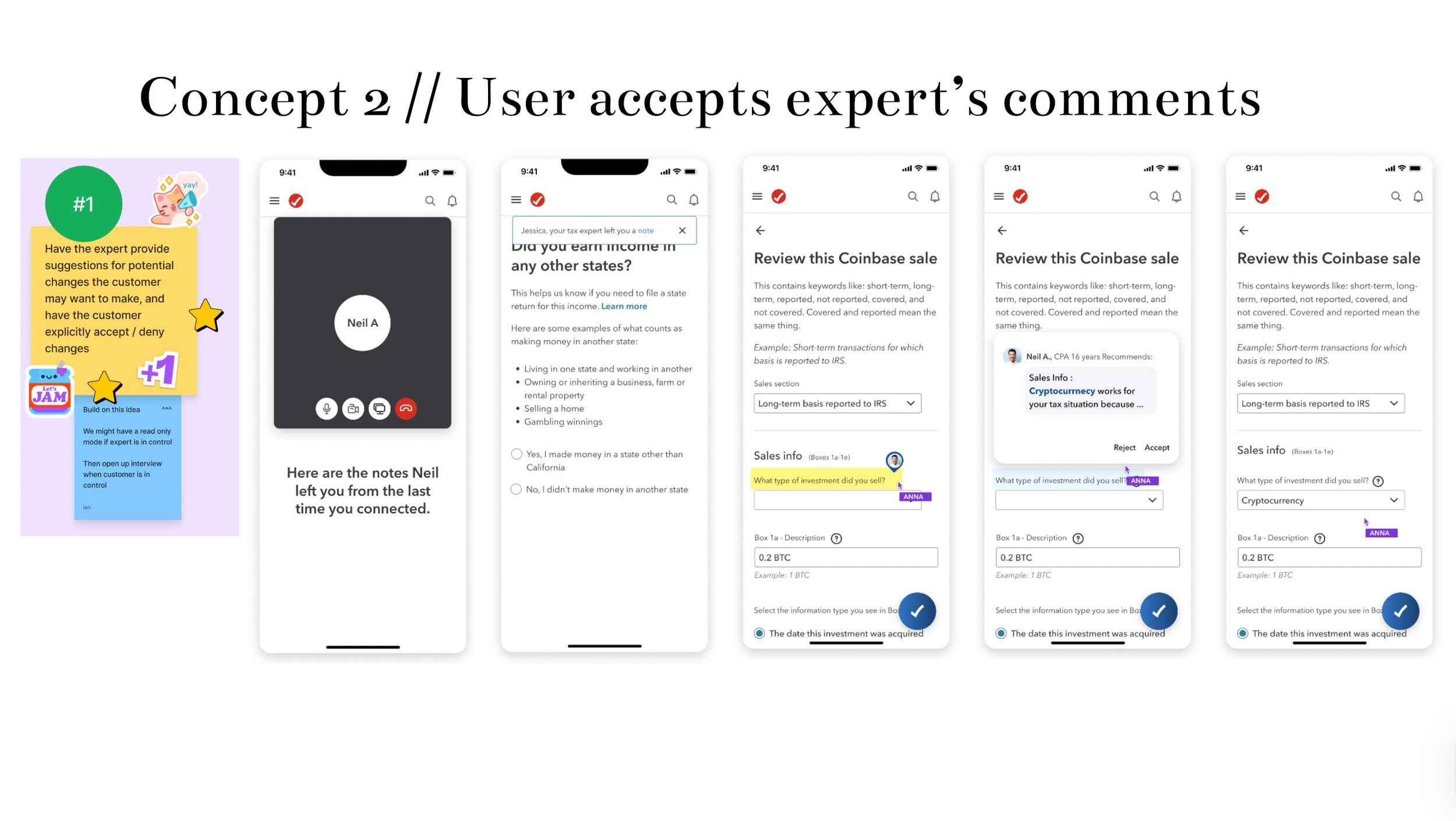

Expert collaboration models including suggestions/comments that users can accept/reject

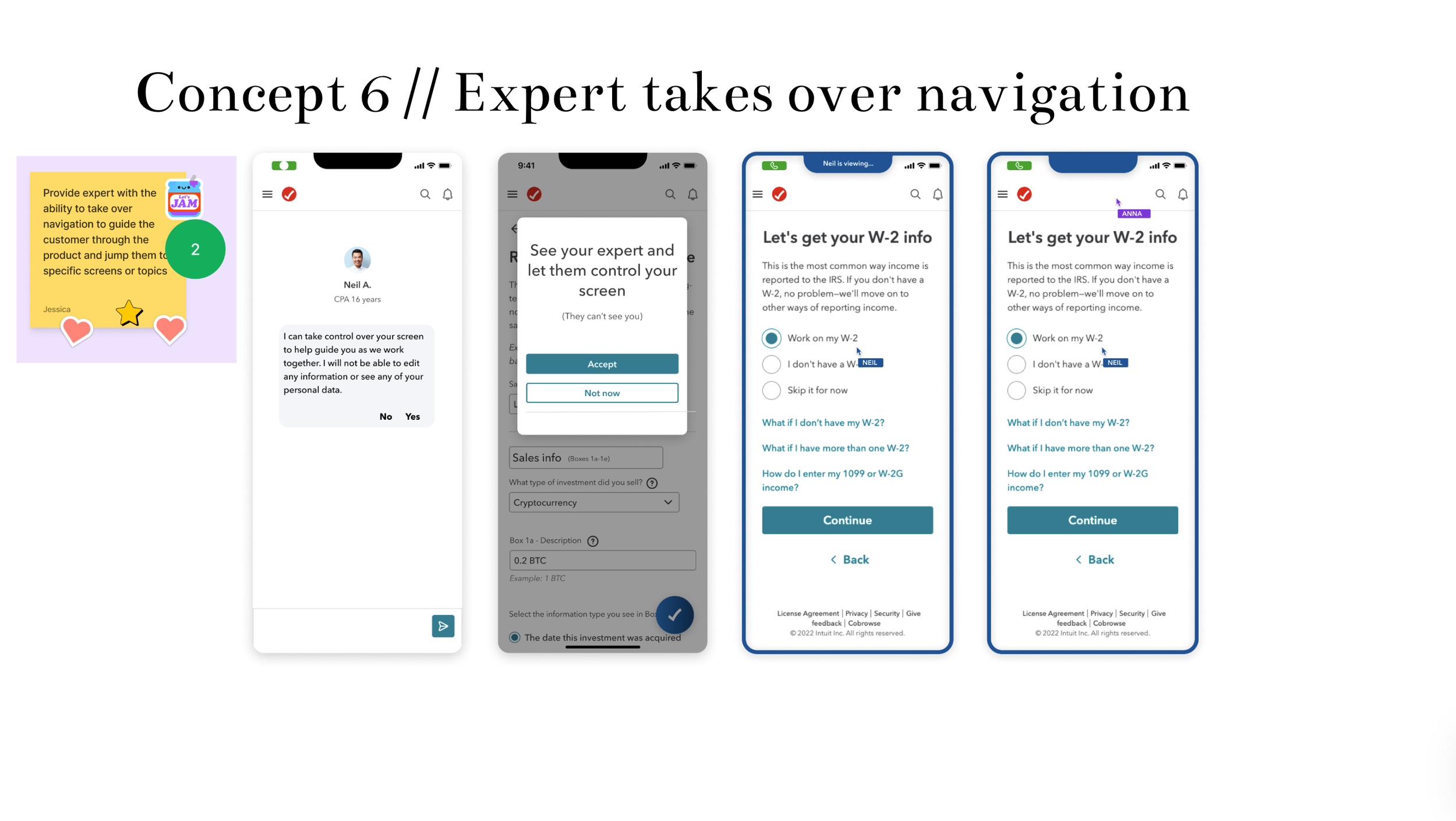

Expert screen control capability for guided navigation

Key Learnings & Insights

User Behavior:

Chat take rate was 4x higher than call take rate, but chat conversion rate was lower than calls

70% of users saw the micro-delegation modal, but only 7% opted to get help with state tax

45% of customers who engaged with the offer connected for live help

Critical Findings:

Users want control and transparency over expert involvement

Proactive intervention timing is crucial—too early creates friction, too late misses the need

Legal constraints (Section 230) and delegation thresholds created implementation challenges

Success Metrics

Results: Overall results were flat across key metrics, leading to project pause and design direction pivot.

Learning Objectives Addressed:

Identified customer preference for personalized collaborative assistance

Determined specific areas requiring hands-on expert support

Established baseline willingness to opt into micro-delegation

Confirmed chat as the preferred communication channel over phone

Reflection

This project highlighted the complexity of balancing user autonomy with expert assistance. While the concept of micro-delegation resonated with users, execution challenges around legal constraints, delegation thresholds, and user expectations led to a strategic pivot. The research provided valuable insights for future iterations of expert-assisted tax preparation experiences, emphasizing the need for transparent, user-controlled collaboration models.

Future state

We facilitated a brainstorming session with an Intuit Innovation Catalyst alongside cross-functional teams to generate concepts for legal review. The goal was to assess viability against Section 230 compliance requirements.